We are glad to provide Predominant Use Studies (PUS) in accordance with the requirements of the Texas Tax Code and similar regulations in other States. We can work for facilities anywhere in the US. This study is essential to fully exempt particular Electricity or Gas meters from taxes in manufacturing, production and industrial environments. Typically, you may be able to claim a full refund for the taxes already paid during the last 3 or 4 years! This can be a significant amount of money.

Contact us today to discuss your need for a PUS. And take advantage of our 20+ years of experience.

We have been trusted by these worldclass customers...

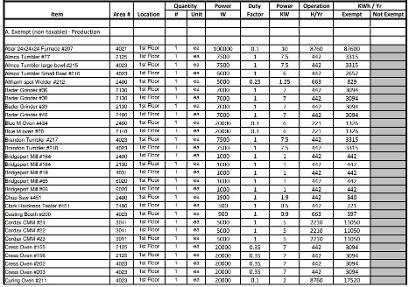

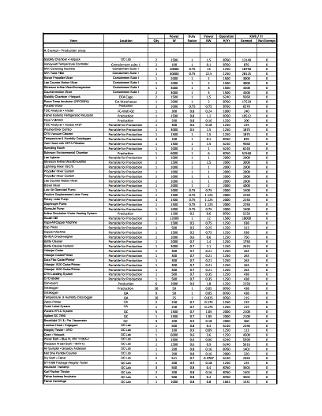

SAMPLE REPORT EXCERPTS:

From PUS for an industrial facility in Dallas, TX

Fr From PUS for an industrial facility in Sugar Land, TX TX

And by these others: